While many were expecting a longer pause in the raising of interest rates by the US Federal Reserve it seems that the June pause that saw the benchmark interest rate maintained at a target range of between 5 % and 5,25 % may be short lived.

📈 Mastering inflation does not appear to be an easy challenge, especially in the services sector, which should lead to a now widely anticipated hike at the end of July, followed by a pause taking into account the languishing manufacturing sector. 𝗕𝘆 𝘁𝗵𝗲 𝗲𝗻𝗱 𝗼𝗳 𝘁𝗵𝗲 𝘆𝗲𝗮𝗿, 𝘁𝗵𝗲 𝗯𝗲𝗻𝗰𝗵𝗺𝗮𝗿𝗸 𝗿𝗮𝘁𝗲 𝗺𝗮𝘆 𝗲𝘃𝗲𝗻𝘁𝘂𝗮𝗹𝗹𝘆 𝗵𝗶𝘁 𝗮 𝗿𝗮𝗻𝗴𝗲 𝗼𝗳 𝗯𝗲𝘁𝘄𝗲𝗲𝗻 𝟱,𝟱 % 𝗮𝗻𝗱 𝟱,𝟳𝟱 %. No rate cuts are anticipated by Fed officials until 2024 🚫

📉 In the UK recent signals show a more important than expected slowdown of Headline CPI in June and also a market slowdown in food inflation. If other indicators evolve in the same direction (wage data), 𝘄𝗲 𝗺𝗮𝘆 𝗲𝘅𝗽𝗲𝗰𝘁 𝘁𝗵𝗮𝘁 𝘁𝗵𝗲 𝗕𝗮𝗻𝗸 𝗼𝗳 𝗘𝗻𝗴𝗹𝗮𝗻𝗱 𝘄𝗼𝘂𝗹𝗱 𝗼𝗽𝘁 𝗳𝗼𝗿 𝗮 𝟮𝟱 𝗯𝗽 𝗿𝗮𝘁𝗲 𝗵𝗶𝗸𝗲 𝗶𝗻 𝗔𝘂𝗴𝘂𝘀𝘁 (in state of the foreseen 50 bps) 💷

🌍 Looking at the behavior of Western economies, we should not expect a more accommodating rate policy in Europe for some time 🏦

𝗪𝗵𝗮𝘁’𝘀 𝘁𝗵𝗲 𝗶𝗺𝗽𝗮𝗰𝘁 𝗳𝗼𝗿 𝘆𝗼𝘂𝗿 𝗰𝗼𝗺𝗽𝗮𝗻𝘆?

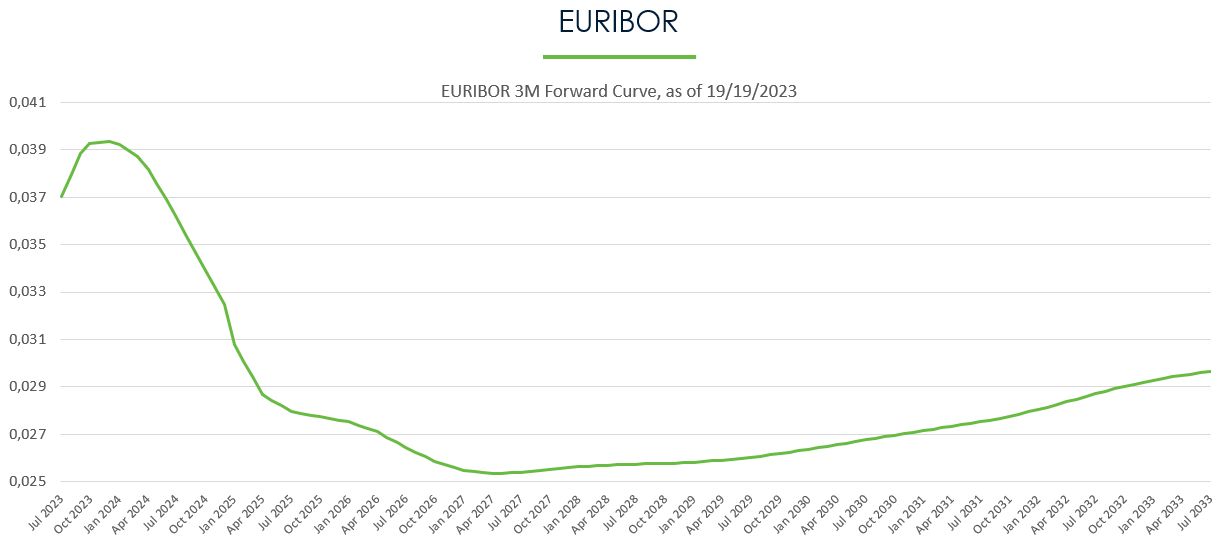

⌛ Higher interest rates are here to stay. Even though long term forward rates curbs still show a high rate on short term and decreasing rates on longer term. Isn’t time pushing this pike forward, finally ending up with long term higher rates?

Companies financed through short term rates already felt increasing finance costs. Mid- and long term financed companies are still (partly) benefiting from fixed interest rates on longer term contracts, but are anxiously looking at the end date of those facilities…

📲 Ernest Partners is there to help you review your financing structure and anticipate higher financing cost. Interested? Send us a PM?