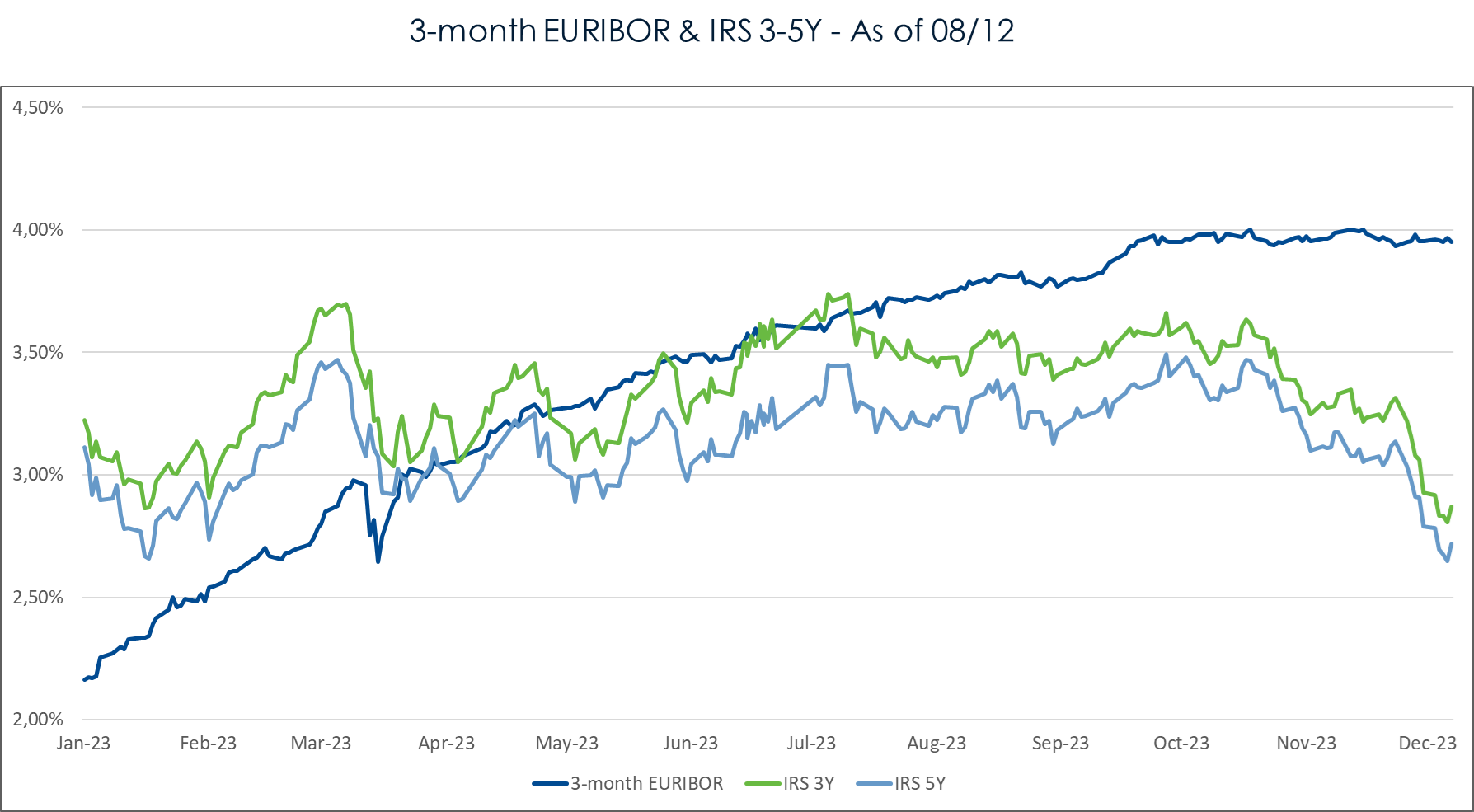

As market interest rates experience a notable upward trend, we have observed an unconventional scenario since July 2023 where short term interest rates surpass their long term counterparts.

Chart 1

To gauge short term interest rates, the 3 month Euribor stands out as a key benchmark1 The 3-month Euribor rate represents the rate at which European banks lend funds denominated in euros to one another for a 3-month period. Meanwhile, the forward Euribor curve provides insights into the future rates as anticipated by the market.

On the other hand, the long term interest rate can be measured through the IRS rate2 The IRS rate corresponds to the exchange of fixed interest payments against variable ones over a specified period. In this analysis, we focused on the 5-year IRS.

As of December 8, the EUR 5-year IRS reached 2.72 %, while the 3-month Euribor stood at 3.95 %. This unusual divergence, where short interest rates surpass longer term rates, opens interesting opportunities for hedging interest rates risks But how can a leveraged company capitalize on this?

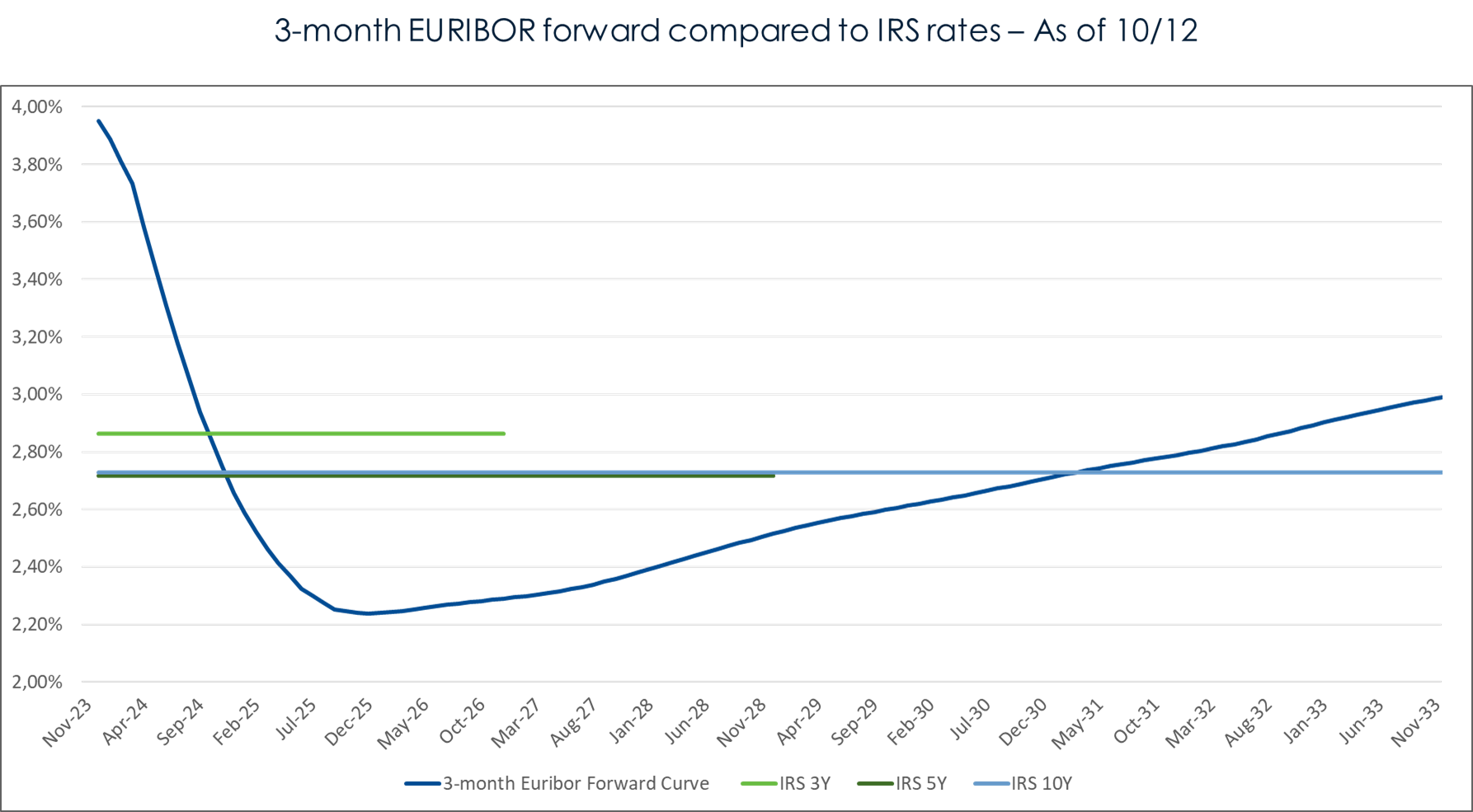

The subsequent analysis delves into the potential short and long term impacts for a company opting to hedge its financial costs by choosing a 5-year IRS. The underlying rationale is that the company perceives a risk of interest rates remaining higher than anticipated by the forward curve and seeks to secure the current rate at 2.72%.

Chart 2

Short-term:

In this concise analysis, we define short term as the period during which the short term rate is expected to be higher than the long term one , roughly until December 2024 (see Chart 2).

Hedging your financial costs with a 5-year IRS at 2.72% enables you to pay lower interest rates in the short term than the current market rate of 3.95%. This leads to a positive carry for around a year, allowing your company to generate more cash during this period while securing a stable funding rate.

Long-term:

1. If market expectations materialize and interest rates decrease, as indicated by the decline in the 3-month forward Euribor curve, the additional interest paid with a 5-year IRS will represent the hedging premium paid to secure a stable rate. While this entails paying more interest, it secures a rate that is relatively moderate if we look at the past two decades. It is important to highlight that forward curves represent the market expectations and, historically, have rarely materialized.

2. If the interest rate remains higher than expected , depending on the extent your company will have secured a lower interest rate and may have saved on its financing costs.

Using data from December 10 2023, we quantified three simplified scenarios to assess the hedging premium3. Simplified premium that does not take into account transaction costs. We assumed a 5% discount rate to actualize the interest payments. your company would pay (or receive) annually on a 5 year loan based on Euribor movements:

Table 1

Scenario 1: If the 3 month Euribor precisely follows the expected rate outlined by the forward curve, the difference in rates with the 5-year IRS will result in higher financial costs. More specifically, locking in the 2.72% rate will entail a hedging cost estimated at 13 basis points per year for your company.

Scenario 2: If the 3-month Euribor during the next 5 years is lower by 50 bps than what is anticipated, the difference in interest rates between with the 5-year IRS will translate into higher financial costs than scenario 1. To be more specific, securing the 2.72 % rate under these conditions will result in a hedging cost of 58 basis points per year.

Scenario 3: Conversely, if interest rates remain higher than expected by 50 basis points during these 5 years, your company pays lower interest rates by opting for an IRS compared to following the market’s variable rate. More specifically, your company will have saved 32 basis points annually on financial costs.

In conclusion, whether to hedge financial costs depends on your outlook and your risk appetite. If you anticipate decreasing interest you might decide not to hedge. Conversely, if you want to stabilize your interest costs and buy yourself a peace of mind , or if you expect higher rates than forecasted by the market, you might consider hedging accordingly. You may also consider building scenarios specifics for your business assessing your capacity to absorb a negative evolution of the rates.

So, what’s your take? To hedge or not to hedge?

At Ernest Partners we advise companies in the search for financing for their projects , this includes developing a relevant hedging policy.