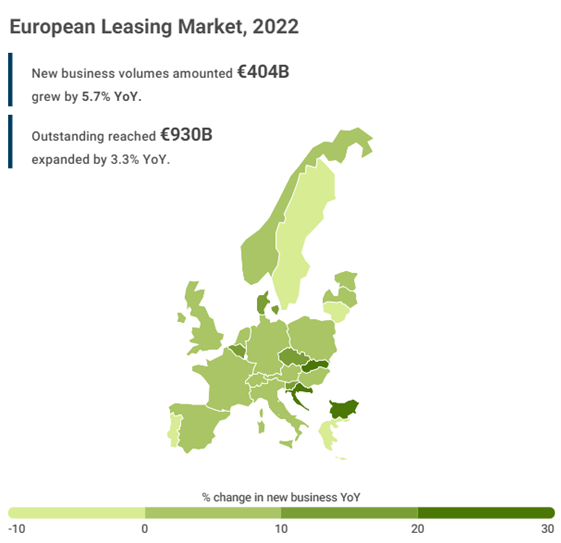

Source: Lease Europe

Belgian entrepreneurs tend to neglect the wide variety of leasing solutions for their most important investments.

The financial commitment needed for both movable and immovable properties is typically substantial, regardless of the project’s size. Consequently, companies often find themselves needing to inject a significant amount of their own capital to secure financing. However, leasing companies primarily specialize in assets rather than financing, allowing you to preserve your capital and make a good deal with a leasing company. Since they have ownership of the asset, they dare to go further.

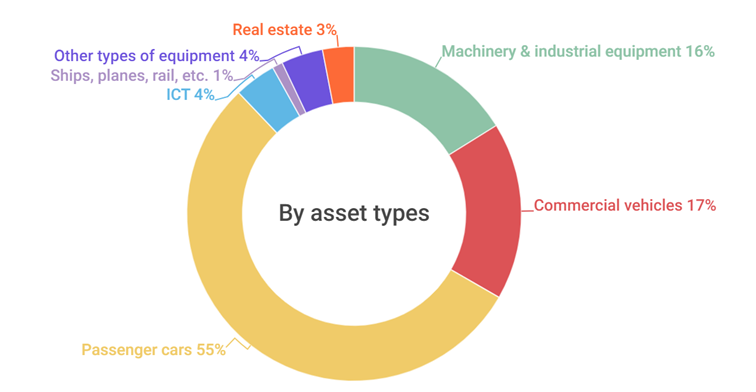

In Belgium, for typical assets like cars and common machinery, companies can easily seek leasing options from the leasing companies linked to the 4 big banks. However, when the investment exceeds EUR 10 or 20 million, securing financing becomes more challenging. The difficulty intensifies when dealing with specialized assets like airplanes, ships, helicopters, large cranes, and industrial facilities such as hydrogen plants. Additionally, financing a new plant in a neighbouring European country often requires a substantial equity contribution, typically ranging from 50% to 60%. Obtaining bank funding for assets located on a different continent poses an even greater challenge.

Nevertheless, the global market boasts a diverse array of leasing providers, each offering a variety of leasing solutions. These companies specialize in different types of assets, ranging from cars and aircraft to specific machinery. Lease amounts can vary significantly, with some companies facilitating leases for as little as EUR 1.000, while others set a minimum threshold of EUR 20 million. Some leasing providers facilitate cross-border leasing, while others do not. This diversity often leaves companies uncertain about whom to approach, leading them to resort to traditional loans and commit to equity contributions of 40% or more.

Companies continue to struggle with the task of identifying the ideal leasing partner for their specific projects in particular countries. Simultaneously, leasing companies face difficulties in connecting with customers that align most suitably with their offerings. This ongoing struggle highlights the need for improved mechanisms or platforms to facilitate more seamless matchmaking between companies and leasing providers.

Source: Lease Europe

Sale & Lease Back

In de ups and downs of the economy and the life cycle of your company, the need for cash arises, whether for expansion or to restructure your financing.

Many leasing companies are interested in refinancing your company’s equipment that still has a sufficiently long lifespan. Exploring this option is certainly worthwhile.

A sale & lease back transaction generates cash to repay the bank, establish a financial buffer, or finance assets abroad, and it is generally more advantageous than having financial resources tied up in various tangible assets.

Real Estate

Real estate holds a prominent position, especially in Belgium, and banks readily finance it for the assurance it provides. While a building or factory may show signs of aging, the increasing value of the land over the years should not be underestimated. This continual appreciation translates into a substantial capital gain on the property after a 10 years. If a nice chunk of bank financing has already been paid off, a sale & lease back can be an ideal solution to unlock cash. In such cases, opting for an “Erfpacht- and leaseback” minimizes tax leakages. Do consider negotiating a buyback option at a low residual value, otherwise you will lose ownership of the real estate. Essentially, a leaseback in this scenario mirrors traditional mortgage financing: once the company repays the loan, ownership is regained, and the property becomes free and unencumbered.

How Ernest Partners can help

Are you in need of financing for new equipment or real estate? Are you seeking to refinance company real estate with a robust lease contract? Do you prefer a swift process facilitated by experienced specialists?

Ernest Partners is ready to assist you in analysing your situation and collaborating with you to develop the most tailor-made lease solution while ensuring precise implementation. If required, Ernest Partners will find additional financing to make your business dream come true.

In 2023, Ernest Partners started an exclusive cooperation with D-Lease, a company that offers real estate leasing solutions in Belgium with low tax impact. For specific equipment lease requests, D-Lease & Ernest Partners collaborate to identify the most suitable leasing partners in Belgium and Europe. But we also like to look further by exploring leasing solutions beyond the European borders.