Want to know what will happen in the European economy in the upcoming year? Check what’s going on in the US.

Ernest Partners is following some economic trends in the US for you:

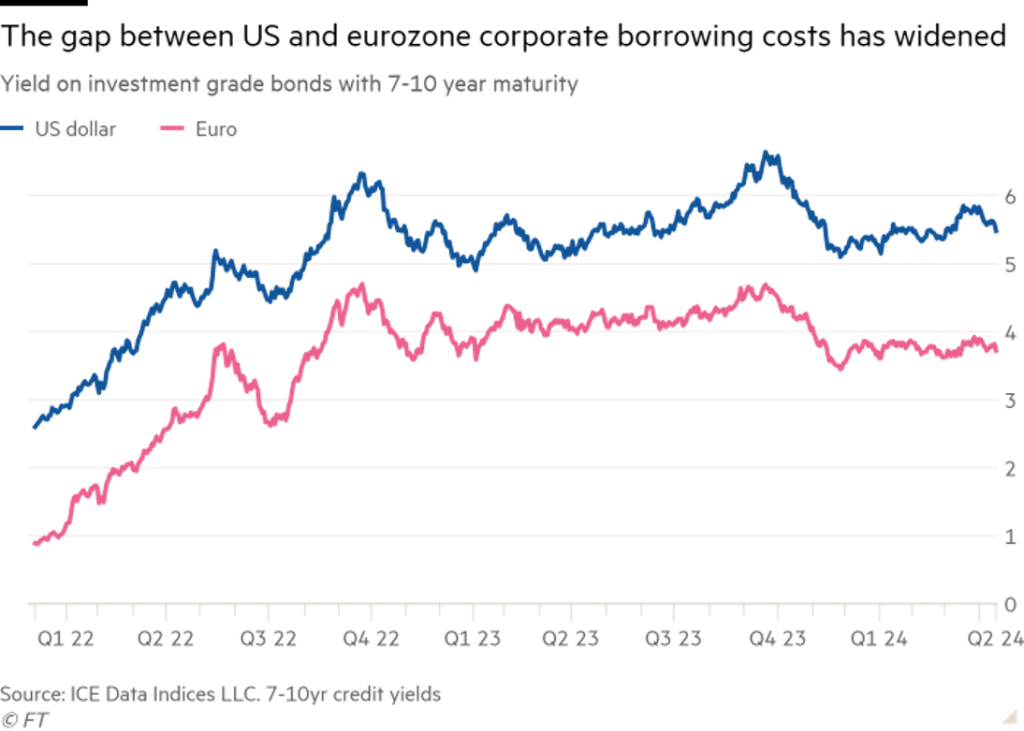

- US Corporates are diversifying their funding by visiting the European bond market. Interest rates between the US and Europe differ that much that for a US Corporate it becomes interesting to get Euro funding to partly fund their US business. This article from the Financial Times clearly demonstrates that there is potential for USD 85 bln of lending in Euro this year. The actual interest gap settles around 1,5% and is increasing. Of course attention has to be given to the currency hedging part related to the reimbursement of the Euro funding and the total balance has to be assessed.

2. The ECB has hinted multiple times that a rate cut is to be foreseen in June 2024. US market data on inflation become more favorable enabling the US FED to probably not increase interest rates anymore, but the booming US economy does not yet allow for cutting US rates. ECB rates decreasing while US rates remain stable opens even more the door to US Corporates diversifying their funding with Euros.

What does this all lead to: the USD upward trend started in January this year, which was based on the USD being a safe haven in times of major international geopolitical tensions, has reversed more recently to a downward trend.

Did you book your holidays in the USA this year… ? What should you do now as an experience CFO ?